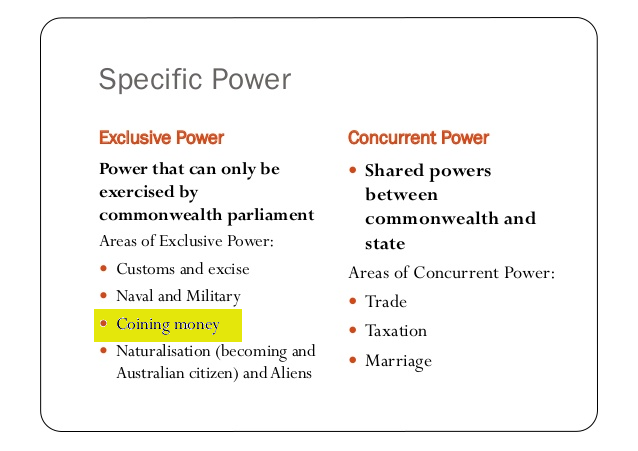

Under our current Constitution, Part V – Powers of the Parliament, Section 51 (xii), it states that “The Parliament shall, subject to the Constitution, have power to make laws for the peace, order, and good government of the Commonwealth with respect to: (xii) currency, coinage, and legal tender;

In 1927 the international banks forced the privatization of the Commonwealth Bank of Australia that was previously owned by the people of Australia. For a full account of how we lost the Commonwealth Bank, read The History of the Commonwealth Bank. As a result, the international bankers forced the government to introduce laws that allowed private banks to create debt money, also known as “fiat money”. Since then, private banks have strengthened their stranglehold on issuing money. As a result, the government issues a fraction of the money in circulation today. Most of the money is in the form of debt to private banks.

Under our current Constitution, Part V – Powers of the Parliament, Section 51 (xii), it states that “The Parliament shall, subject to the Constitution, have power to make laws for the peace, order, and good government of the Commonwealth with respect to: (xii) currency, coinage, and legal tender;

In 1927 the international banks forced the privatization of the Commonwealth Bank of Australia that was previously owned by the people of Australia. For a full account of how we lost the Commonwealth Bank, read The History of the Commonwealth Bank. As a result, the international bankers forced the government to introduce laws that allowed private banks to create debt money. Since then, private banks have strengthened their stranglehold on issuing money. As a result, the government issues a fraction of the money in circulation today. Most of the money is in the form of debt to private banks.

Australian currency should be issued only by a government bank owned by the people under the authority of the Constitution.

This has resulted in a massive debt that Australia can never repay. It is obvious that we must extricate ourselves from the debt slavery the international banking system has placed us in.

In 1937 when the Commonwealth Bank was “the People’s Bank” there was a royal commission into the Monetary and Banking system. In Section 504 of the Commission’s Report the following statement appeared. “…the Commonwealth Bank….can even make money available to the Governments free of any charge…”

This statement created such controversy that the Chairman of the Commission, Mr Justice Napier was asked to explain.

He replied through the Secretary of the Commission as follows: “The statement means that the Commonwealth Bank can make money available to Governments or to others on such terms as it chooses, even by way of a loan without interest, or even without requiring either interest or repayment of principal.”

Dr Jim Cairns, former Deputy Prime Minister and Treasurer of Australia in his book, “Oil on Troubled Waters” (Widescope, 1976, p 56) made the following statement: “The power to create money and to decide who should get it is a vast and significant social and economic power, and for this reason, the Labor movement has always believed it should not be a privately owned power but be exercised solely by a public or peoples’ bank…”

Therefore, we propose initiating the following changes:

- The Australian economy shall be managed to serve the best interests of Australian society and not as an end in itself

- A new central bank, to be called the Central Bank of the Australian Commonwealth (CBAC) shall be created to replace the Reserve Bank of Australia. The CBAC shall be owned by the People of Australia in perpetuity as a Statutory Authority

- The CBAC shall be responsible for issuing all money on behalf of the Government

- The Monetary policy enshrined in our Constitution shall not be changed except by the People voting at referendum

- The CBAC shall not be sold or privatised in any way at any time

- The CBAC shall be the sole source of new money in the Australian economy. Such money shall be created as notes and coins and as credit

- Except in the case of an emergency declared by the Parliament, the Central Bank of the Australian Commonwealth shall only issue credit against the tangible wealth-creating capacity of the Nation

- Australian currency shall have a fixed value in comparison with other world currencies as determined by the Parliament on the advice of the Central Bank of the Australian Commonwealth. (This means that the Australian dollar will not “float” as is currently the case. This is to prevent fluctuations that can destroy savings, hamper business planning, distort the value of exports and imports, and destroy confidence. It will also discourage currency speculation – an activity that makes a few people rich but that adds nothing to the well-being of Australian society.)

- The CBAC shall not indulge in any form of international currency or commodity dealing

- The CBAC shall not borrow money or any other financial instrument or accept credit from any foreign nation or foreign corporation

- The CBAC shall manage all monies according to directions from Parliament

- All funds accrued by government and agents of the Commonwealth shall be remitted to the Central Bank of the Australian Commonwealth

- Expenditure of funds from the CBAC shall occur only according to the rules laid down in the Australian Constitution

- The CBAC shall monitor the Australian economy including revenue from taxation, natural resource royalties and property title levies and advise the Parliament of any need for adjustment. The primary economic management tool shall be the creation of more or less new money depending on availability of labour and other resources

- In time of emergency such as war or recession, the Central Bank of the Australian Commonwealth shall create such currency or grant such credit to the National Treasury as is required

- As and when approved by the Parliament, the CBAC shall control the money supply through grants to national revenue, through loans to private financial institutions and through loans to private enterprise

- Grants to national revenue shall be interest free and shall not require repayment

There shall be a Board of the Central Bank of the Australian Commonwealth.

The Board shall comprise:

- the Chairman appointed by the President on the advice of Parliament,

- two Members nominated by the Department of Treasury,

- two Members nominated by the private banking sector,

- two Members nominated by rural industry,

- two Members nominated by manufacturing industry, and two Members nominated by the services sector.

The Board shall be accountable to the Parliament and shall report to the Parliament on a regular basis as determined by the Parliament. The Chairman shall be called before the Parliament to answer questions as required by the Parliament.

The Board shall convene every two weeks, and as required.

The Board shall pursue a policy of zero percent (0.0%) inflation and full employment by:

- controlling the money supply,

- controlling the amount of credit available in the community,

- monitoring the cost of production (labour and resources) and making such adjustments as are possible,

- monitoring supply (of such things as power, fuel, transport, land) and making such adjustments as are possible,

- monitoring prices and wages to ensure no price/wage spiral,

- monitoring and where necessary prosecuting persons or corporations exploiting customers,

- monitoring population increase or decrease and advising the National Parliament of necessary policy changes,

- Monitoring the activities of Government Departments, and

- Monitoring the Australian economy and releasing funds to government only as is consistent with sound economic policy.

The approval of the Central Bank of the Australian Commonwealth shall be sought before amounts in excess of 100 times Male Average Weekly Earnings is brought into or taken out of Australia.

The Central Bank of the Australian Commonwealth shall collect a 10% surcharge on all monies brought into and carried or sent out of Australia to overseas countries.

In Australia it shall be illegal to:

- Import, export, buy, sell or deal in any way with foreign financial currency or financial instruments of any kind.

- Monies derived overseas from the sale of Australian produce and services or any other means shall be remitted to the Central Bank of the Australian Commonwealth in the first instance, and shall be passed on to the authorized recipient in Australian currency by the Central Bank of the Australian Commonwealth.

Monies to be remitted overseas in payment for imports shall be remitted through the Central Bank of the Australian Commonwealth. Only Australian currency shall be used in Australia. The importation, possession, purchase, use or sale of foreign currency shall be illegal.

Fiscal Arrangements

All national revenue shall accrue to and be distributed by the Central Bank of the Australian Commonwealth (CBAC).

Fiscal arrangements between the CBAC, the National Treasury and Regional Treasuries shall be enshrined in our Constitution where they my not be changed except by the People voting at referendum.

- The National Parliament shall be responsible for raising all revenue needed for governance. All revenue shall be remitted in the first instance to the Central Bank of the Australian Commonwealth.

- The CBAC shall calculate the funds to be released into the economy based on the Board’s economic assessment. The Parliament shall review the assessment by the Central Bank and shall retain the right of veto and to make recommendations for change.

The CBAC shall release money into the economy by:

- Grants to National and Regional Governments,

- Loans to Private individuals and corporations (at 5% interest), and

- Loans to Private banks and other financial institutions (at 3% interest) — (This will ensure that interest rates are fixed, giving confidence to investors and home buyers)

- Until varied by the People voting at referendum, the Central Bank of the Australian Commonwealth shall distribute the funds to be released to Government as follows:

- 25% shall be allocated to the control of the National Parliament through the National Treasury, and

- the remaining 75% shall be divided and allocated to each of the approximately 100 Regions on a per-capita basis up to a maximum of 250,000 persons. (This cap of 250,000 means that urban regions will see disadvantage in allowing ever-increasing population growth and thus decentralisation is encouraged.)

- All funds allocated to the National Government shall be handled through the National Treasury.

- Funds allocated to the National Treasury shall only be disbursed according to the Constitution and legislation passed by the Parliament.

- All funds allocated to Regional Governments shall be handled through Regional Treasuries.

- Funds allocated to a Regional Treasury shall only be disbursed according to this Constitution, legislation passed by the Parliament and Ordinances passed by the Regional Assembly.

- Regions shall not be restricted on how funds are expended within the Region except as constrained by National policy.

This allocation of national revenue has been calculated using 2007 budgetary allocations for the services prescribed for each level of government in the Constitution. If the People decide this allocation should be varied, the People can change it by voting in a referendum.

This provision also means that the National Parliament has access to 25% of national revenue for Defence, Foreign Affairs, Customs, Immigration, etc. and each Region receives a share of 75% of national revenue (on the basis of population) for education, welfare, health services, law and order, and so on.

By enshrining these fiscal arrangements in the Constitution, many of the problems currently experienced are eliminated.

To illustrate, Neil Warren submitted a report for the New South Wales Government titled ‘Benchmarking Australia’s Intergovernmental Fiscal Arrangements, (2006)’ and stated that: “The conclusion of this study is that Australia performs comparatively poorly in intergovernmental fiscal arrangements.… Australia’s system of intergovernmental fiscal arrangements is characterised by very high vertical fiscal imbalance (VFI) due to inadequate State tax powers, and complex and high level equalisation.”

Current problems will not be fixed by following the old maxim that, “he who spends should tax” (so that accountability is achieved by each level of government being seen to be collecting the taxes needed to meet their expenditure.) Rather, the answer lies in having one taxing authority (for efficiency) and open, transparent and obviously equal distribution of revenue to sub-national governments; and that these arrangements should be enshrined in the Constitution so they can’t be manipulated by politicians for political purposes.